Popular donations

We welcome almost all car or trucks, trucks, vans, fleet cars, trailers, boats, motorcycles, and Mobile homes, based on approval. We have reps standing by to answer virtually any concern you could possibly have like: "what you have the ability to donate?" and even "what status of cars and trucks are normally taken?" Please call us toll free at: (888) 228-1050

What records are documentation is required?

In most cases In Most of the times we will most likely require the title to the motor vehicle, but each and every state has its specific requirements. Even in the case that you do not find your title form, get in touch with us anyway; some other options can possibly be worked out in a large number of scenarios in many cases. You may check with us by calling us toll free at: (888) 228-1050

We appreciate your car or truck donation, and we plan to help make that doable for you. If you have other concerns, you can easily check our cars and truck donation Frequently Asked Question. Our reps are on hold on the telephone, willing to help you ascertain any paperwork you need to donate your car.

Will I have the ability to pick up a tax write-off?

Definitely, vehicles donated to certified not-for-profit organizations are actually tax deductible. Due to the fact that we are a 501( c)( 3) not-for-profit organization, your car or truck donation to Driving Successful Lives is totally tax deductible. After we obtain your automobile donation, we will certainly charity car donation mail you a receipt that lists your tax deduction amount.

In general, if the auto you contribute sells for lower than $five hundred, you can declare the fair market value of your automobile up to $500. If your donated vehicle yields more than $500, you will have the chance to claim the particular amount of money for which your automobile sold. Learn more about how the IRS allows you to claim a tax deduction for your car donation on our IRS Tax Information page.

Your car donation to an IRS sanctioned 501( c)( 3) charity is still tax deductible and will certainly click here fall into either of these particular classifications:

1. For car or trucks marketed for under $500, get more info you can absolutely claim the reasonable market price as high as $500.00 with no extra documentation. The initial tax receipt will definitely be mailed immediately after motor vehicle has been validated picked up.

2. If the complete receipts from the sale of your donated auto go beyond $500.00, your credit will be capped to the actual final sale rate. You will also be asked by the donee organization read more to provide your Social Security for the purposes of completing its IRS Form 1098-C form.

Our staff will certainly supply you with a letter relating the final selling price of your vehicle within just 30 days of its sale.

Will you provide absolutely free pick-up?

Of course, we will pick up the car or truck operating or not for free, from a locality that is advantageous for you. When you fill out our web donation form we will phone you the very same or consequent business day to plan your car or truck pick-up. If you make your motor vehicle donation simply by phoning us at: check here PHONE. We will definitely arrange your pick-up then.

Exactly who benefits?

Our vehicle donation solution assists local charities that support children and families in need of food & shelter. Your motor vehicle donation helps to make dreams come true in a lot of ways-- including xmas gifts.

We moreover deliver finances to enterprises that help Veterans.

Your car donation benefits disabled United States veterans through raising funds to produce funds for assorted programs to help maintain their essentials.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Tia Carrere Then & Now!

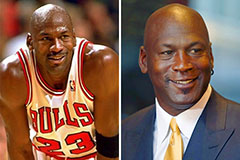

Tia Carrere Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!